In the dynamic landscape of the Bitcoin market, crafting a deaccumulation strategy before a full-fledged bull run is prudent. Establishing predefined selling points not only enables the realization of gains but also sets a solid foundation for swing trading. The aim is to increase the number of bitcoins during the subsequent bear market—always with the understanding that returning to the original holding may be unlikely. This caution reflects the conservative nature of such a strategy.

A General Counsel for the Far-Sighted

Adopting the low time preference approach—hodling is not just a meme but a long-term investment philosophy—is pivotal. This perspective underscores the importance of foregoing immediate pleasures for enduring values. With the halving events that limit the supply of new bitcoins, it becomes increasingly crucial to consider each satoshi carefully.

Imagine a place where the value of your Bitcoin can directly translate into a real-world experience, such as owning a Bitcoin Tikibar. This whimsical thought experiment highlights the potential of Bitcoin not just as an asset to hold but as a means to create tangible experiences in the future. It prompts us to question the real value of our holdings and how we might choose to use them—one day, could 0.1 BTC indeed secure a unique asset like a Bitcoin Tikibar?

However, recognizing that a balanced approach can secure one’s standard of living and open doors for further Bitcoin accumulation is vital. Sales should be strategically planned to avoid emotional trading and to allow space for targeted reinvestment. This is where our personal journey, income, life expenses, health, and life stage come into play, highlighting the profound uniqueness of each Bitcoin holder’s situation. As such, this decision is deeply personal, and no one-size-fits-all advice can be given.

Overall, it’s a strategy of balance—between utilizing profits for the present and an unwavering belief in Bitcoin’s future. This strategy is a testament to the desire to use Bitcoin for what it truly is: not just digital gold, but also a tool for freedom and financial wisdom.

With the anticipation of future bull markets and the inevitable scarcity of bitcoins, investors should not lose sight of the long-term vision. Hodling with a low time preference is a discipline that demands not just restraint but also an understanding of one’s individual circumstances.

And in the end, remember:

1 Bitcoin will always be 1 Bitcoin!

But the journey to hold or sell is deeply personal, informed by our unique life stories, challenges, and aspirations. This nuanced approach honors not just the value of Bitcoin but the diverse tapestry of its holders’ lives.

The concept of a Bitcoin Tikibar serves as a playful yet profound metaphor for the choices and possibilities Bitcoin offers. Just as the “First Rule of Bitcoin” meme and the iconic imagery of a “Matrix-inspired Bitcoin reality” serve to remind us of the fundamental principles and the transformative potential of Bitcoin, the idea of translating Bitcoin into real-world experiences like owning a Bitcoin Tikibar encourages us to dream big while staying grounded in the practical considerations of our individual financial journeys.

Strategic Considerations for Bitcoin Deaccumulation

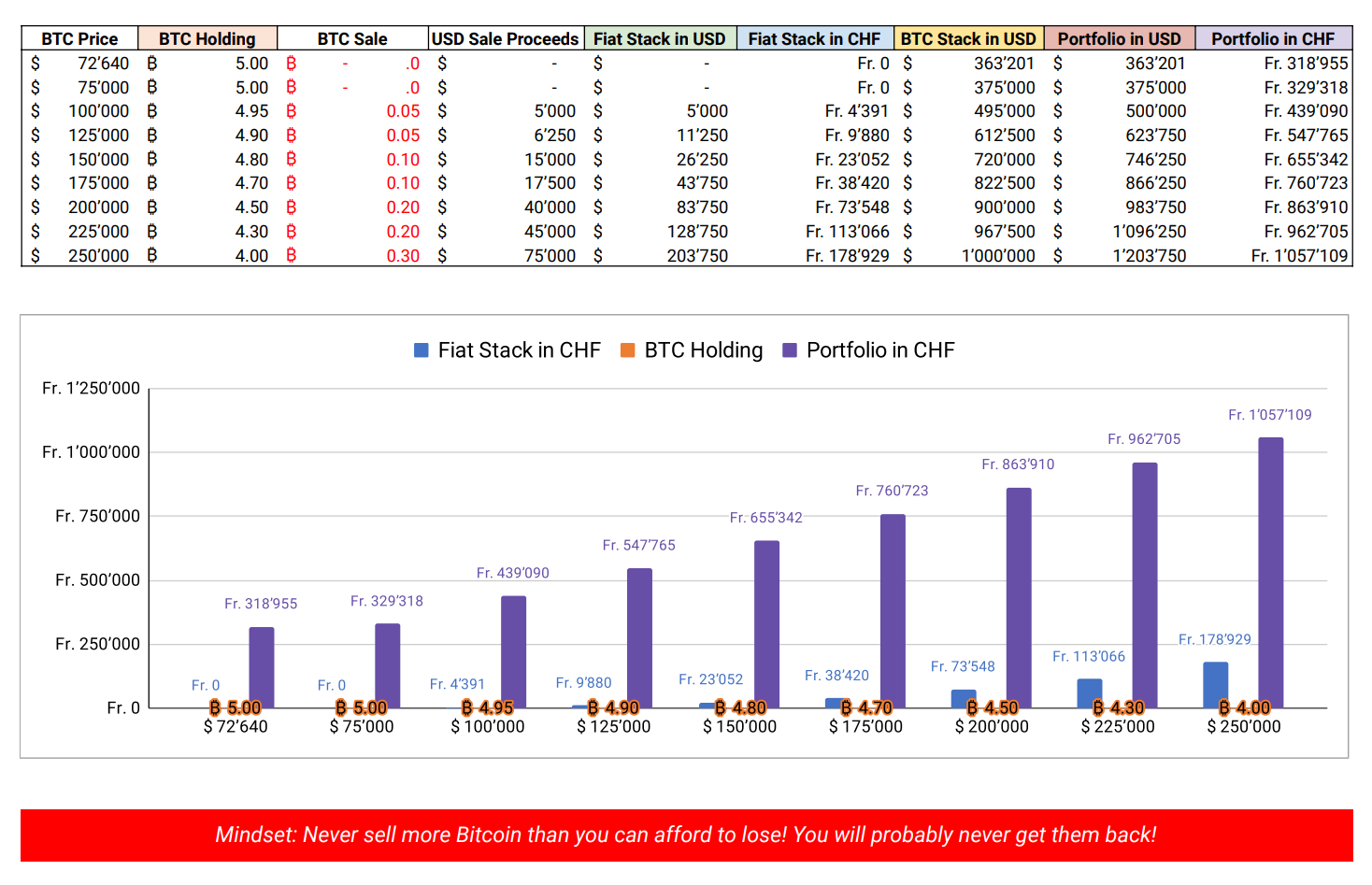

The discussion surrounding Bitcoin deaccumulation strategies ultimately revolves around a crucial tool: a detailed Google Sheet developed to illustrate and plan this strategy. This spreadsheet encompasses various scenarios from 1 to 5 BTC to establish potential selling points before a full bull market ensues. It’s crucial to emphasize that this strategy does not aim to time the market—a challenge that often leads to failure even for the most experienced. Instead, the focus is on making rational decisions before the desire for more becomes overwhelming.

Here are the core points of the strategy as presented in the spreadsheet:

- Set Price Targets: Define in advance at which price levels a specific portion of Bitcoin holdings will be sold. With selling points ranging from $100.000 to $250,000, a clear guideline is provided on how to gradually reduce holdings to realize gains without completely missing out on further increases in value.

- Fixed Holding Points: The strategy emphasizes the importance of holding onto Bitcoins and only selling what one can afford to lose. The aim is to never find oneself in a position where a forced sale undermines financial independence and long-term vision.

- Portfolio Diversification: By strategically selling smaller amounts of Bitcoin at rising prices and converting them into fiat currency, the strategy not only secures profits but also facilitates a diversification that reduces the overall risk of the portfolio.

This text aims to provide an unbiased view on strategizing Bitcoin deaccumulation, explicitly avoiding personal advice, recommendations, or financial advice.